The Brief

Following our successful work on premier finance events like Consensus, we were proud to have been trusted by Hong Kong FinTech Week to manage their Mainland China influencer management and global paid media strategy. Our paid media scope included comprehensive campaign management across Google, Meta, LinkedIn, WeChat, RED, as well as Baidu.

The event’s 10th anniversary, in collaboration with the Startmeup Festival, was undoubtedly set to be a landmark occasion. With an attendance of over 45,000 executives, 1000+ leading speakers, and 800 exhibitors, our strategies for both paid media and influencer relations were designed to ensure this milestone event continued its legacy of impact and evolved into an even bigger, more dynamic event in 2025.

The Objective

We conducted cross-platform marketing on Western and Chinese media to increase event visibility and drive attendance among tech and finance professionals.

The Solution

Campaign Strategy

- Core Communication Pillars

- How to attend + Why attend (agendas, speakers, opportunities),

- 10th anniversary significance with heavy tech focus,

- Sharing the brand story of Hong Kong FinTech Week.

- Audience & Channel Pivot

- Shifted early from limited retargeting to high-volume prospecting,

- Ran integrated campaigns on Chinese social media (WeChat and Xiaohongshu) and Western platforms (Meta, LinkedIn, Google Ads, and Stack Adapt), building community engagement through localised & global content.

- Target & Messaging

- Fintech/tech pros (Web3, Blockchain, AI, entrepreneurs, investors) + finance innovators,

- Core theme: Premier platform for high-value networking, investment deals, and global growth connections.

Meta: The Dominant Driver of Sales & Efficiency

Our advertising performance included:

- Meta: 7 million impressions

- Google Ads: 3 million impressions

- LinkedIn: 350K impressions

- Stack Adapt: 2.5 million impressions

Meta was not just the top performer; it drove the vast majority of all sales, securing 5,230 purchases at an efficient Cost Per Purchase (CPP) of HKD 43.29. This platform excelled at identifying and reaching audiences with high purchase intent. One standout approach involved promoting specific, high-value event features (such as B2B matchmaking sessions), which proved exceptionally powerful, driving 1,209 purchases at an even lower CPP of just HKD 23.63. This showed that focusing on tangible, premium aspects of the event was a highly successful tactic for conversions.

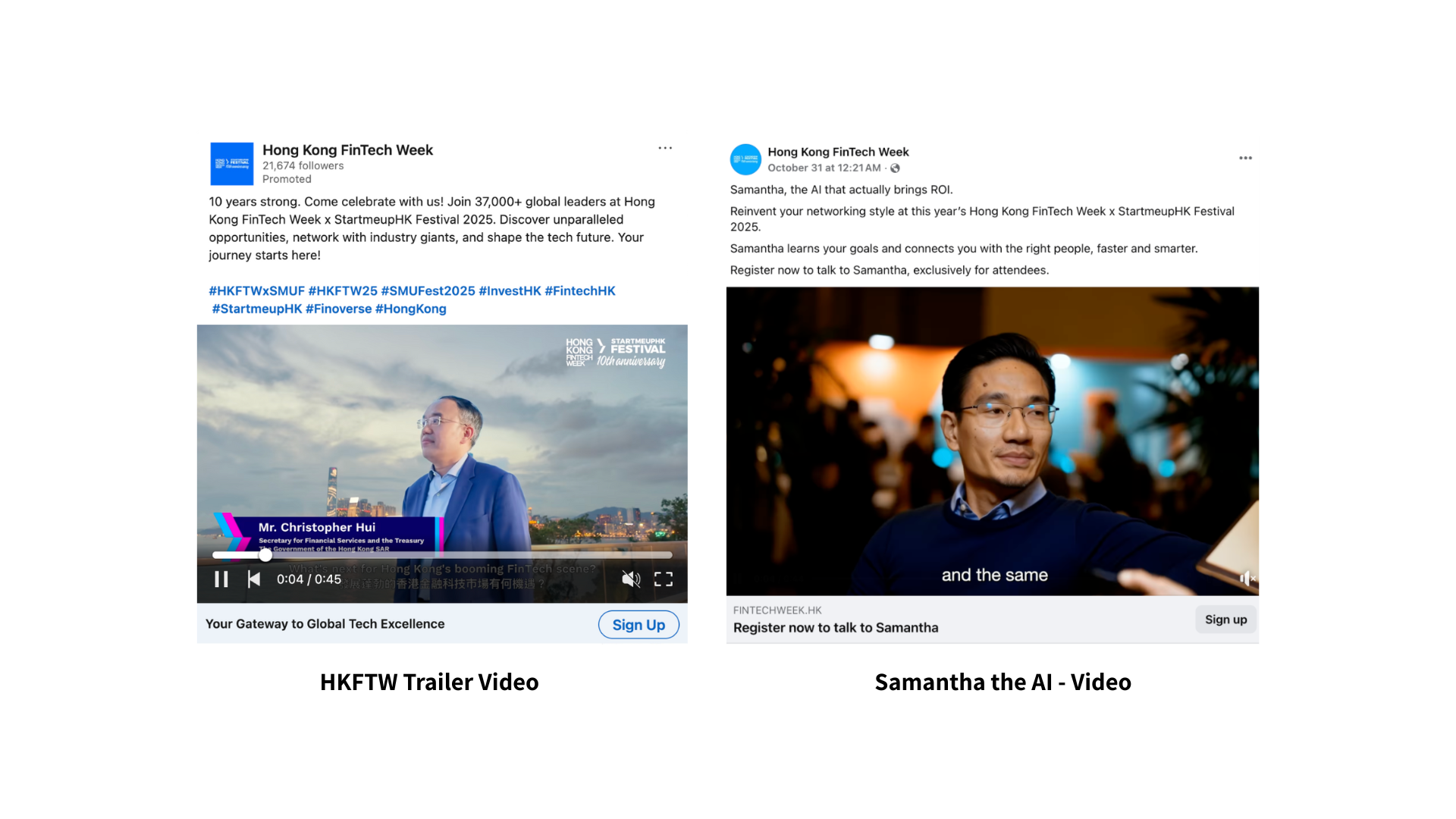

Video Creative Drove the Best Results

On Meta, the top two video ads combined delivered 1,470 purchases. The main event trailer video secured 887 purchases. Most impressively, one creative featuring an AI-themed concept became a superstar, driving 583 purchases at a remarkably low CPP of HKD 10.94. On LinkedIn, the same main event trailer video was the #1 performing creative, responsible for 46 purchases.

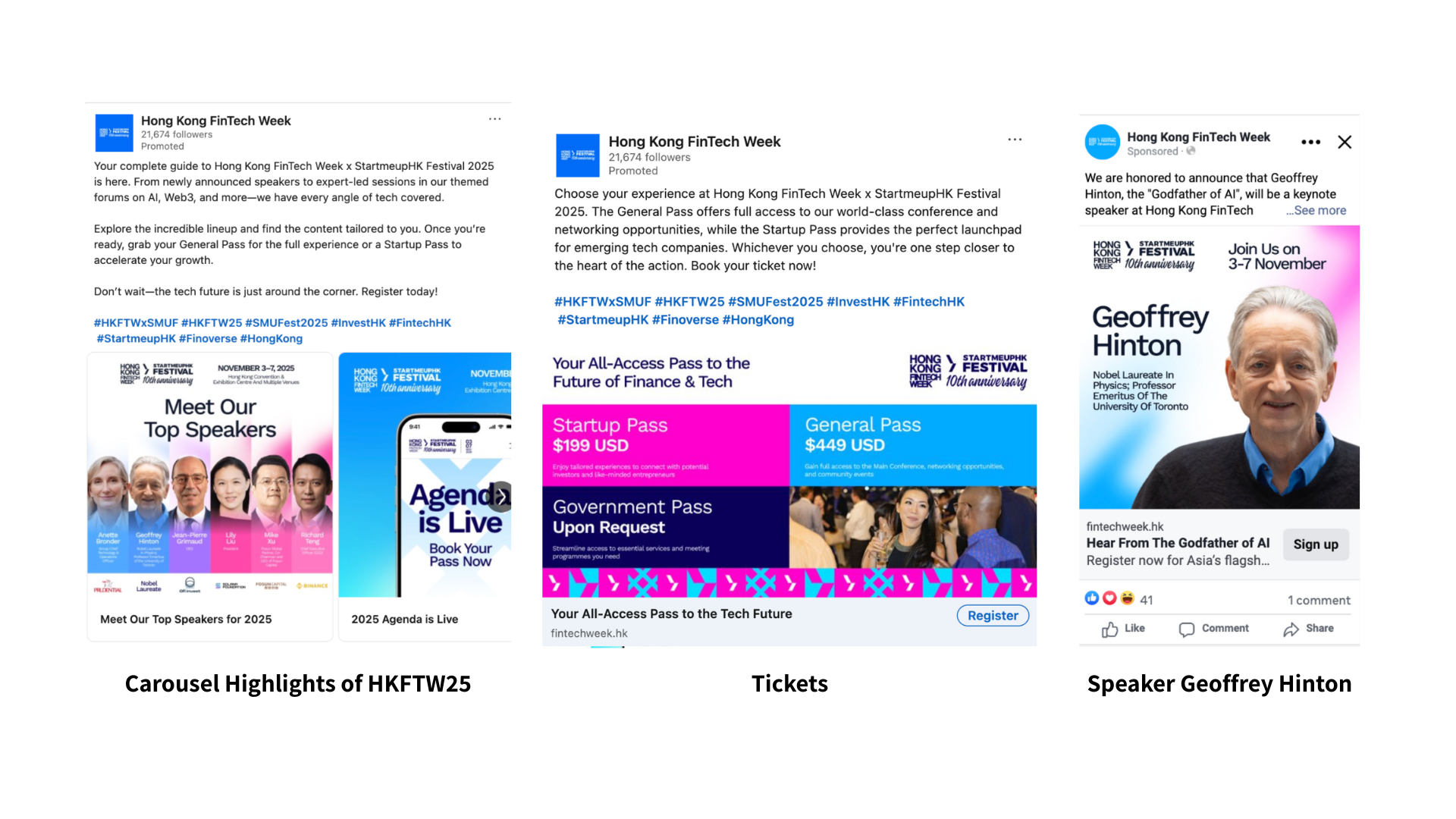

High-Value Content Resonated Strongly

Audiences responded far more to substantive event content than to generic branding. On Meta, an ad highlighting a world-renowned AI pioneer speaker ranked as the third-best performer, driving 427 purchases on its own. Similarly, on LinkedIn, a carousel showcasing key event highlights and features ranked as the second-best creative. This reinforced that spotlighting high-profile speakers and concrete event elements is a powerful driver for ticket sales.

Japan: Untapped Market Potential Identified

GA4 data revealed a significant untapped opportunity. Japan, outside the paid media plan, organically generated 3.4% of all revenue (USD 8,771.55), signalling strong existing demand and a high-quality audience that was currently being missed. By contrast, other markets like Vietnam produced very little revenue (USD 430.00) despite comparable traffic, marking them as lower priority.

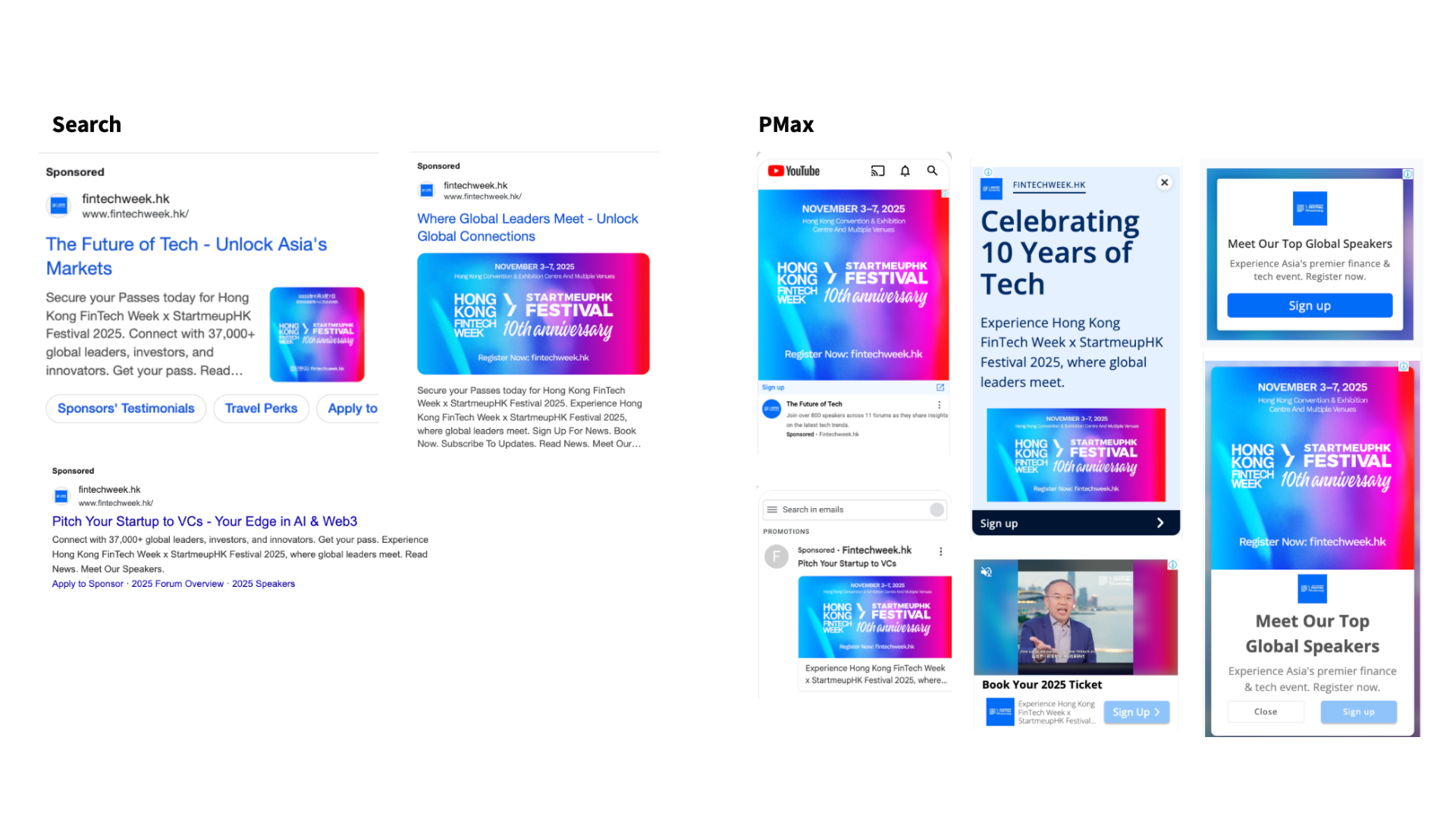

Google Branded Search was a Low-Cost Conversion Catcher

A dedicated branded search effort on Google proved highly efficient, securing 90 purchases at a CPP of HKD 58.69. This was fueled by users already showing strong brand awareness. The top keywords were all branded terms (e.g., “Fintech week” at CPA HKD 8.82 and the event acronym at CPA HKD 10.30). This indicated that many users first discovered the event through other channels (likely Meta or PR) before searching on Google to convert.

PMax and LinkedIn Were Inefficient for Direct Sales

Google PMax and LinkedIn showed high costs per purchase: HKD 749.09 and HKD 1,406.45, respectively. Google PMax delivered a huge volume of low-cost clicks (HKD 0.75), suggesting it excelled at top-of-funnel awareness (e.g., via display and video placements) but struggled to convert those users efficiently. LinkedIn had the highest-cost traffic (HKD 17.97), making it unsuitable for driving mass ticket sales; however, its precision targeting shines for high-value B2B engagement rather than broad direct conversions.

Mainland China: High-impact Expansion

Our performance in Mainland China included:

- Baidu: 500K impressions / 17K clicks

- WeChat: 6.9M impressions / 34K clicks

- Xiaohongshu: 350K impressions / 25K clicks

Baidu was rolled out in six phases over 47 days: early phases focused on testing, data collection, and initial keyword matching; mid-phases boosted brand awareness and budget optimisation; later phases sustained performance while incorporating precise competitor targeting, successfully lifting CTR from 1.7% to 4.1%.

Best performing videos

Campaign content

Google Ads Highlights

Key Takeaways for HKFTW’s Cross-Platform Marketing

- Importance of audience strategy: The successful pivot from retargeting to prospecting audiences enabled us to reach a broader customer base, highlighting the necessity to adapt strategies based on audience size and engagement potential.

- Leverage multiple platforms for visibility: A diverse multi-channel approach significantly enhanced our campaign’s reach and engagement, with impressive impressions across platforms like Meta, Google, and WeChat, underlining the value of integrated marketing.

- Utilising high-value content: Video creatives and targeted ads around specific features of the event proved to be effective in driving conversions. Content that emphasised high-profile speakers and unique elements resonated well with the audience and translated into measurable sales.

- Exploring untapped markets: The organic revenue generated from Japan demonstrated the potential of expanding into new markets. This highlights the importance of ongoing data analysis to identify and leverage emerging opportunities for growth.

About Hong Kong FinTech Week x StartmeupHK Festival 10th Anniversary

Hong Kong FinTech Week is one of Asia’s most influential and largest fintech events. It brings together a global community of financial leaders, regulators, investors, entrepreneurs, and technology innovators.

The event, organised by the Financial Services and the Treasury Bureau and InvestHK, focuses on the latest trends and innovations in financial technology, including AI, blockchain, digital assets, and sustainable finance. It serves as a platform for networking, deal-making, and discussing the future of finance and technology in the region.