In collaboration with Standard Insights, we have undertaken a comprehensive analysis of Xiaohongshu usage across Hong Kong and Singapore, reaching more than 500 respondents in both markets. Following our initial exploration of the Hong Kong market, we will now explore user behaviors and preferences in Singapore. Beyond general user insights, we will specifically examine Xiaohongshu marketing strategies for financial institutions, particularly as they are now encouraged to establish official accounts to enhance their Xiaohongshu presence, while adhering to stipulated posting regulations.

If you are interested in the results of our survey on the Hong Kong Market, read our article:

Xiaohongshu Marketing: a Hong Kong Strategic Guide

What to know about Xiaohongshu Users in Singapore?

Users of the platform in Singapore

Currently, Xiaohongshu’s adoption in Singapore is moderate, with only 22% of respondents actively using the platform. However, a significant 78% of non-users express openness to joining in the future, indicating strong potential for growth. Research and discovery are key motivators for joining the platform, suggesting that Xiaohongshu could evolve into a research-driven content hub in Singapore.

Content Preferences: Practicality over Trends

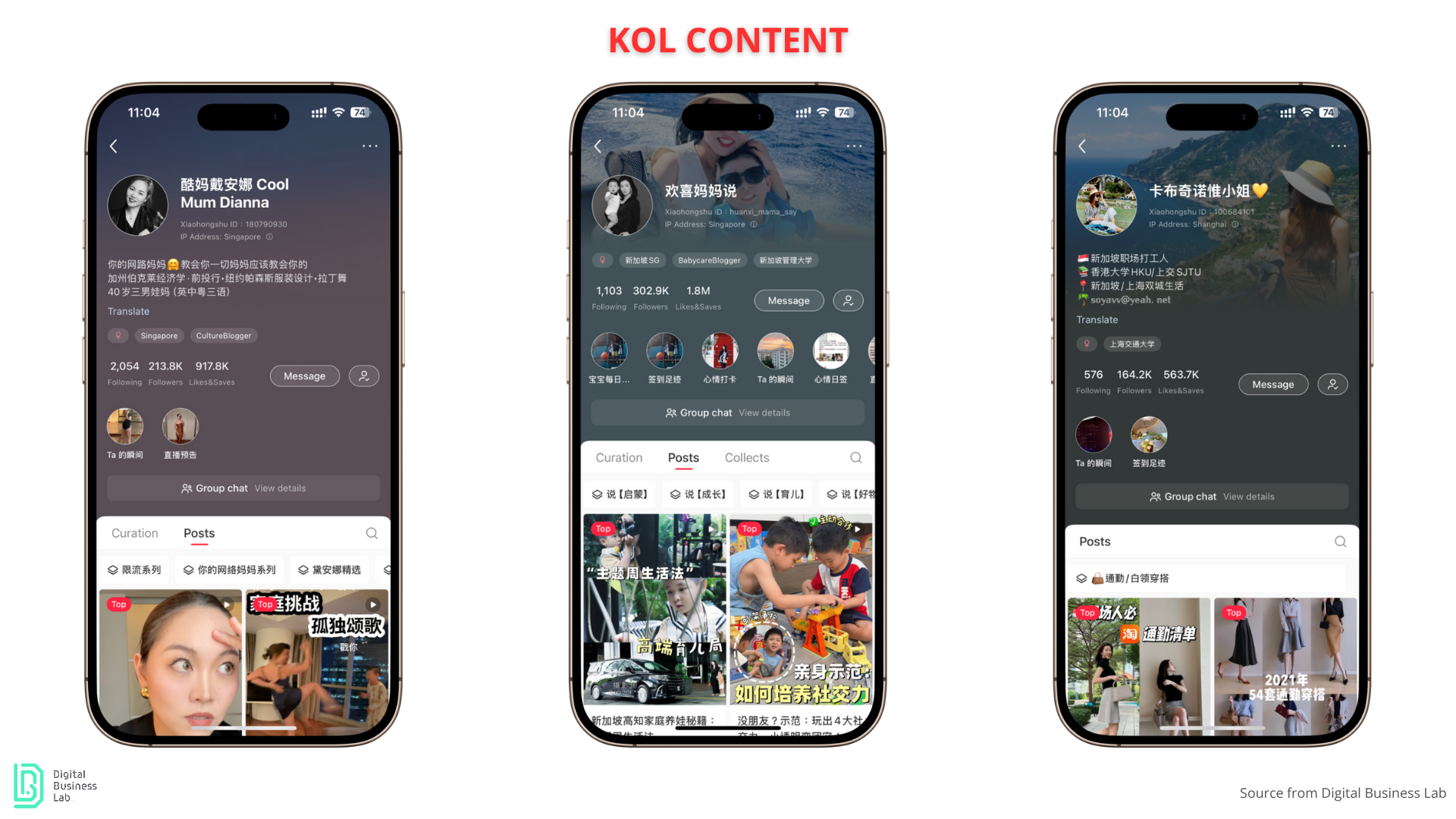

Singaporean users on the platform show a preference for practical content, such as tutorials, product reviews, and personal narratives. In contrast, content centered around trends, deals, and promotions tends to be less effective. Successful content examples include posts from Key Opinion Leaders (KOLs) like @酷妈戴安娜 Cool Mum Dianna, who shares insights on motherhood and self-growth, and @欢喜妈妈说, who focuses on children’s education. Another example is @卡布奇诺惟小姐 provides content on professional life and career tips.

Trust Dynamics among Users

There is a clear preference for peer-generated content (47%) over brand-generated content (23%). A successful content strategy should therefore prioritize leveraging real users and relatable voices, including community educators, employees, and customers sharing authentic experiences.

Seeking advice on Xiaohongshu

Most Singaporean users do not yet actively seek advice on Xiaohongshu. The primary reasons cited for this include not considering the platform for advice (39.4%), perceiving replies as irrelevant (30.3%), and receiving insufficient responses (9.2%).

Among the small subset of respondents who did use Xiaohongshu for advice, 12.8% reported receiving qualitative answers, 6.4% received responses from many users, and only 1.8% actually received answers.

These findings likely stem from the platform’s emerging adoption in Singapore. Users are not yet accustomed to asking questions or expecting relevant replies. Brands that proactively engage, respond to inquiries, and foster comment-driven conversations have a unique opportunity to lead and define financial conversations on Xiaohongshu before the platform becomes saturated.

Check out our previous series of articles on Xiaohongshu:

Little Red Book Marketing: What’s new in 2024 and how brands leverage it? (1/2)

Little Red Book Marketing: What’s new in 2024 and how brands leverage it? (2/2)

Xiaohongshu Marketing Insights for Financial Institutions and Insurances

While Xiaohongshu is not a primary platform for finance-related research, with only 4.6% having searched for financial topics, there is significant openness. In fact, 63.3% of respondents would consider following financial brands on Xiaohongshu. This indicates a substantial untapped opportunity. With high-quality content, banks and insurers can establish a dominant presence in the financial category on Xiaohongshu early on.

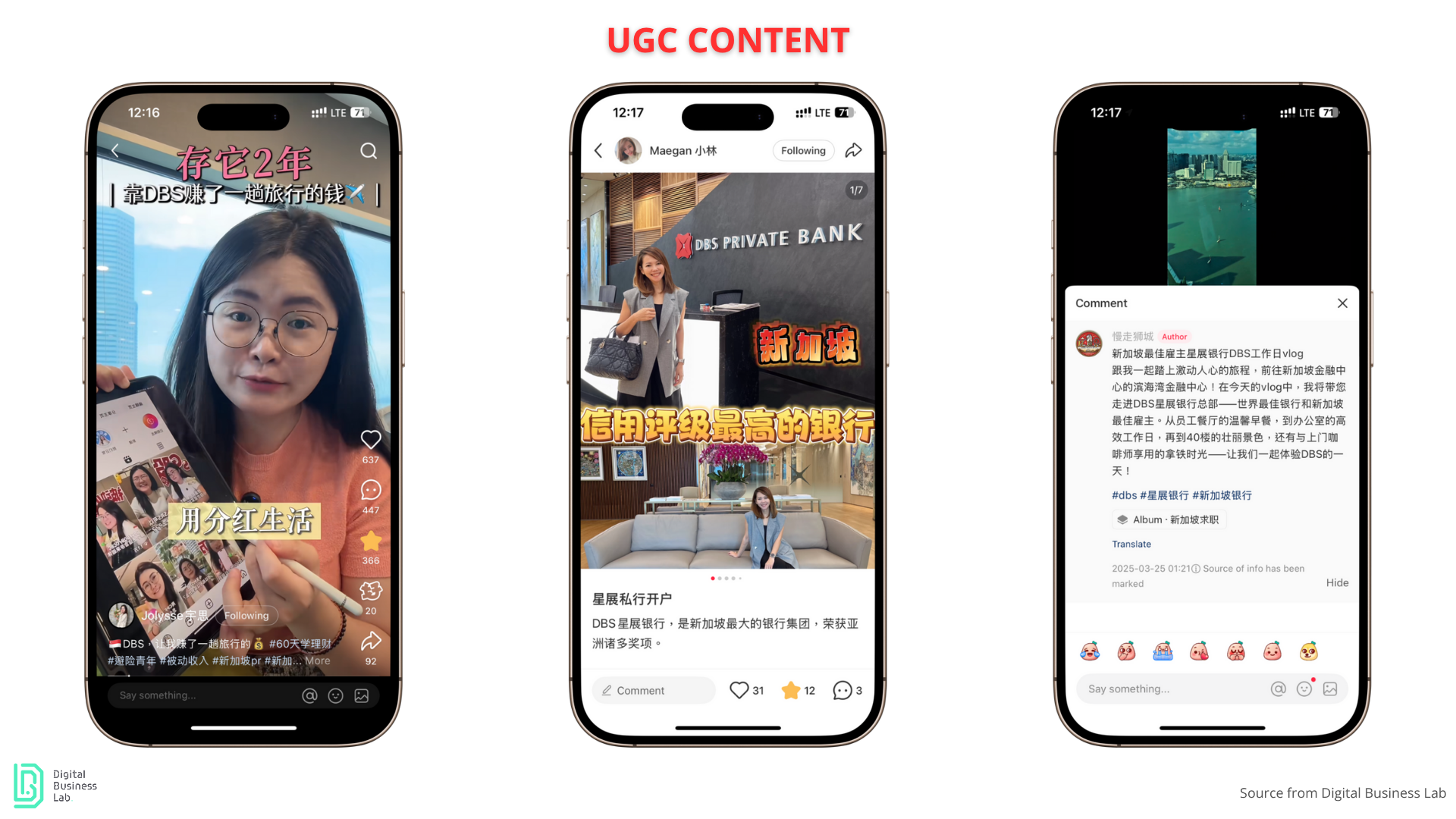

Few Singaporean banks and insurance companies have a direct presence on the platform; however, there is a significant volume of user-generated content related to these institutions. This content includes practical advice on account opening and accessing benefits. Furthermore, it appears that banks promote employee advocacy, with some users sharing vlogs detailing their work experiences.

Financial institutions can also establish a presence on Xiaohongshu through strategic collaborations. For instance, UOB partnered with Xiaohongshu’s official art account to promote their sponsored FutureLab art event in Shanghai. Another example involves a PR post by the Hong Kong news media “the Culturist,” which featured an interview with an artist at Art Central and highlighted UOB’s sponsorship of the art event. While UOB does not maintain an official account, their engagement through sponsored art events demonstrates a common and effective strategy for institutions of this nature to achieve visibility on the platform.

Effective Content for Audience Building

Our survey reveals that Singaporeans desire simple, clear, and helpful financial content. The most preferred content types include easy-to-understand tips (30.4%), educational explainers (28.7%), and step-by-step guides (12.5%). Similar to Hong Kong respondents, promotions and storytelling content are less effective.

Strategic Content for Financial Institutions in Singapore

For Singaporean finance and insurance brands, Xiaohongshu presents a low-competition, high-potential content channel. While users are not yet searching for financial products, they are actively exploring and learning, and are receptive to discovering helpful, transparent, and authentic voices. Based on survey responses, we recommend that financial institutions maintain a straightforward and practical approach:

- Prioritise financial education over promotion: Develop “Finance 101” explainers and “step-by-step” guides for financial goals, such as setting up savings accounts.

- Leverage peer credibility: Employ a User-Generated Content (UGC) style approach, featuring employees sharing real-life financial hacks or explanations. Collaborate with local, predominantly bilingual influencers who can simplify policies and terms.

- Focus on consistency, not virality: Xiaohongshu values trust-building. Maintain a steady content rhythm aligned with search and discovery habits, rather than chasing viral trends.

- Integrate with the broader customer journey: Use Xiaohongshu to generate interest and then direct users to chatboxes or inquiry mailboxes. The goal is to initiate a trustworthy relationship, not to close sales directly on the platform.

Key Takeaways for companies launching on Xiaohongshu

- Only 22% of Singaporean respondents currently use Xiaohongshu, but 78% of non-users are open to trying it, indicating significant future growth potential.

- Among both current and potential users, the primary motivations are research and discovery, not direct purchasing.

- The most popular content types are tutorials, reviews, and personal stories, while trends and deals/promotions are less engaging.

- User-generated content is preferred (46.8%) over content from influencers (30.3%) or brands (22.9%).

Key Takeaways for financial institutions

- Financial content remains niche:

- Only 4.6% have searched for banking/insurance topics.

- Just 0.9% currently use Xiaohongshu for finance research.

- However, 63.3% would consider following a financial brand if the content is useful or interesting.

- These trends suggest that while Xiaohongshu is not yet a primary platform for finance (with Google remaining the main preference), it holds potential as a discovery and education channel, particularly for digitally curious younger audiences in Singapore.

- Singapore’s Xiaohongshu platform lacks a strong financial advice community, likely due to low adoption and limited interaction. Brands that proactively engage and encourage comment-driven conversations can shape the financial discourse before the space becomes competitive.

Discover projects where Xiaohongshu significantly boosted their impact:

(1) Xiaohongshu Influencer Marketing: Driving Immediate Leads for HK7s in Mainland China

(2) AIA Carnival: Xiaohongshu Influencer Marketing in Hong Kong: Boosting AIA Carnival ticketing

(3) Goyard: Launching their official Xiaohongshu account and repurposing their global content